Monday, January 18, 2010

Bidirectional Solar Tracking System

Solar power is the conversion of sunlight to electricity. Sunlight can be converted directly into electricity using photovoltaic (PV).

Electro-optical solar trackers are usually composed of at least one pair of anti-parallel connected photo-resistors or PV solar cells which are, by equal intensity of illumination of both elements, electrically balanced so that there is either no or negligible control signal on a driving motor. In auxiliary bifacial solar cell, the bifacial solar cell senses and drives the system to the desired position and in PC controlled date and time based, a PC calculates the sun positions with respect to date and time with algorithms and create signals for the system control. This thesis use the combination of three methods above method in order every minute there is 90 degree incident light fall on the PV cells.

As briefly, this thesis is about a bidirectional solar tracking photovoltaic system. Bidirectional movement is being actuated by two dc motor. A H-type motor driver is designed in order to control motor in 4 mode, forward, reverse, forward breaking and reverse breaking. Motor is being controlled by a programmed PIC18F4250 that receive signal from sensors.

The motors change the altitude and longitude angle of 20 pieces series connections of PV cells, in order the sun’s incident angle is always perpendicular to the PV cells. Most of the converted energy is used to charge up batteries instead of supplying power for the control and driving system. Dimension of the PV cell is 15cm X 30cm, total 20 pieces PV area is 0.9m.

Dimension of mirror is 15cm X30cm, total 30 piece mirror area is 1.35m. Solar concentration ratio is 2suns. V of solar cell is about 16V and 130mA, hence nearly 2W per piece. Estimated cascade 20pieces of PV will give 35W due to several power losses in the circuitry and other relevant factor.

Increase demand for green tech to bring down cost

Increase demand for green tech to bring down cost

By DHARMENDER SINGH

PUTRAJAYA: Malaysia will have to first have a plan to increase demand for renewable energy sources like solar panels if it is to truly promote the use of cheaper and more environment friendly power sources, said Energy, Green Technology and Water Minister Datuk Peter Chin Fah Kui.

Chin said the Government was serious about pursuing the use of renewable and efficient energy sources and the formation of the National Technology Council headed by the Prime Minister himself, that would meet in December for the first time, was proof of its commitment.

However the price of alternative power sources like solar or photovoltaic (PV) panels was still not low enough for a large portion of the people in Malaysia to use because, despite having several large manufacturers of such panels, local demand was still too small to allow for mass production.

“The solar PV industry can generate cumulative business revenues of more than RM560bil by 2020 or 4% of the national GDP (Gross Domestic Product), as well as turn Malaysia into a knowledge-based and high-technology manufacturing and services base capable of creating up to 100,000 jobs.

“But the only way to increase demand and allow mass production is by increasing awareness among the public on the benefits of using alternative power sources as well dispelling misguided notions that such options are expensive and low in efficiency,” he told a press conference after launching the Second National Photovoltaic Conference 2009 here on Tuesday.

Chin said progress had been made in the use of renewable energy in Malaysia despite having listed it as fifth fuel source in 2001, but things were set to change further with the allocation of RM1.5bil for green technology under Budget 2010.

“We have also finalised the new National Renewable Energy Policy and Action Plan which we will unveil after it is endorsed by the Cabinet, hopefully next month.

“With this I hope renewable energy will play a prominent role in our future energy mix and contribute significantly to our future economic development,” he said.

He said the Government was aiming to have 5% of the power in the country coming from various renewable sources, apart from hydro-electric plants, by the year 2050.

While it seemed like a modest target, he said, the Government was taking into account that it would take time for the people to turn to such power options.

World Council for Renewable Energy general chairman Dr Hermann Scheer, who was also at the press conference, said that even Germany had experienced a slow start when it first started to move towards introducing renewable energy sources several decades ago, although now it was known as one the most advanced in its use.

He said the percentage of increase in the use of PV and other sources of renewable energy would increase annually and once it had gained momentum, it would be possible to have entire communities running completely on them as could be seen in various places in Germany.

Chin said he also hoped that developers would play a part in promoting the use of solar panels by installing them in the houses they constructed and also called on people to demand such added features when they purchased such properties.

Tuesday, March 3, 2009

KLCI drop again!!!

PETALING JAYA: The KL Composite Index (KLCI) tumbled 14.1 points, or 1.6%, to 876.6 yesterday, off its intraday low of 868.7

Losses on Bursa Malaysia were mainly led by heavyweights. Malayan Banking Bhd (Maybank) fell 14 sen to RM4.96, TM International Bhd lost 33 sen to RM2.69, Bumiputra-Commerce Holdings Bhd dropped 35 sen to RM6.55 and Public Bank Bhd declined by 30 sen to RM8.50.

4/3/2009 Public Bank was 20 sen lower at RM8.20, MISC-foreign declined 20 sen to RM8.00, UMW fell 10 sen to RM5.20 and TNB lost 10 sen to RM6.20.

PETALING JAYA: Overall loan approvals in the country fell for a fifth consecutive month in January, down 35.6% on an annualised basis to RM16.6bil.

Bank Negara data released last week showed major loan indicators registering “a moderating trend” in January.

Overall loan applications fell on an annualised basis of 21% in January to RM31.6bil, according to Bank Negara.I am forecasting that the Banking share NAV will continue drop unless there is second time of reducing BLR or longer time period....

Wednesday January 7, 2009

Top Investment

OVER the years, real estate has proven time and again its stability, attractive returns and ability to hedge against inflation. Assuming you have RM100,000 set aside for investment purposes, at least RM60,000 should be invested in properties. Less than RM30,000 go directly into the stock market and the balance (less than RM5,000) into high risks, highly leveraged, volatile investments such as Options, Futures or Foreign Exchange (Forex).First, it's extremely important to build up a solid investment base using real estate before venturing into other investments to give your portfolio regular and predictable rental income and to enjoy capital appreciation

Some trainers mention that you only need less than 20 minutes a day.Yes, only if you have invested at least two hours per day over the next three years mastering the subject - a hidden fact many are unaware of.

The risks here are higher as landed properties will give you negative cash flow if you put in the minimum down payment. Your ultimate goal in property investments is to eventually move to the commercial sector once your budget grows to RM1 million.

Thursday, February 26, 2009

Happy Birthday to me!!!

This is my 22nd birthday!!!

25th of February,6pm i went to UKM to meet my darling, she gave me a memorable night! we played bowling, eat pizza, shopping and shopping, buy and buy a lot, and eat again, sedapnya tomyam! Most happy that she made a "chaiyen" kek for me, delicious! Haha, i was indeed full and happy!! About 11.30pm i reached hillpark, received some birthday wishes from good friends , family and also darling phone call....

Tonight 7pm will go alamanda,putrajaya to meet ee and yen!! hehe, they wan celebrate birthday with me at sushi king!! Then they bought secret recipe cake, put a candle, and sang birthday song to me. I was very very happy!hohoho~~

beside that, i really and indeed thanks a lot to my brother in law, Mr Ong, for present me new fashion spectacles since 2005 till now~ i am paiseh that nearly every year take a new spectacles from you~ "Er Jie Fu" your spectacles is comfortable and nice, therefore i always cari you lo, hahaha! thank you, thank you, thank you!! infinity thank you!

thank you for all of friends and family! i wish you all happy always!! Smile alot!!

at last, i have a deep expression that i had passed 22 times birthday and never say a word of "thanks" to my dad and mum! thanks for them bringing me to this wonderful world! the world is amazing and full of wisdom and curiosity~~ "Mum and dad, thank you! love you both!"

My mummy already 55years old, named WONG FOOK THYE. Daddy called LEW HOCK EWE AGE 56~~~ Mummy is really wong(king), daddy is a pity general nia, even more funny is that all of their 5 children are poor little soldiers!! HAHAHA!! Nevertheless for us, they are cute and funny couple~~ WISH THEM HAVE A DIAMOND MARITAL CELEBRATION soon!

Today i found a good video from youtube, that making me very miss on my parents, especially my mum!!

Pls go youtube, and search the keyword "the mum song" or paste this link to your internet address ( http://www.youtube.com/watch?v=Nem0bkErGVY )

* Thank you darling for reminding me to thank for my parents! You are indeed kind and warm caring person.... Great to have you!!! shi shai ni !

Investment opportunity??

THE STAR Published: Friday February 20, 2009 MYT 1:01:00 PM

Maybank fell 25 sen to RM5.25(maintain), TNB was 20 sen lower at RM6.10(rise back to RM 6.45), YTL was down 15 sen to RM7.00(maintain), Petronas Gas lost 15 sen to RM9.65(rise RM9.85).From my study, i get to know about I-capital.

I capital is managed by Tan Teng Boo( Asia Warren Buffet), launch since year 2000 with RM1.00, year 2006 highest NAV to RM 2.70.

In 2006, Capital Dynamics achieved a major milestone when it established Capital Dynamics (S) Pte Limited in Singapore, its platform for global investing. With this, it became the first Asian-owned fund manager to invest worldwide.

Year 2009 I-Capital NAV RM 1.55 DATED ON 26/2/2009

Year 2007, KLCI reach record high at 1466.67 point.

TODAY 26/2/2009, KLCI only at 896.13......

And yet, now our government cut down the loan interest rate too....... may i apply the knowledge of THE AGE LESS FINANCIAL CLOCK in this case?

Pls study my investment 1 and 2 in order to reduce your risk of investment. Remember to risk diversify and cost averaging method!

Investment 2

After attending the Financial Planning Workshop Part Two, my personal summary is:

Why do people invest?

To provide capital and income at some future time, (money at work)

To beat inflation.

Investment divided into 5 categories, that is

- investing, purchase financial product with expectation of favorable return in long term basic more on property, unit trust, bond...

- trading, buy and sell in short term basic, may buy share....

- speculating following the market trend, like purchasing gold, oil, currency..( dangerous that if you buy after the trend of market, you sure will be a big loser...)

- gambling, toto, genting highland

- banking earn interest via fix deposit

In this section, is only for those their investment goal is to beat inflation.

Knowledge from China, RED CLIFF 1 AND 2, 三分天下! Meaning that diversify your investment into 3 categories. That is 33% into investing, 33% into trading and speculating, 34% into fix deposit. percentage adjusting must do it once a year in order you do not bias into either categories.

Cost averaging method

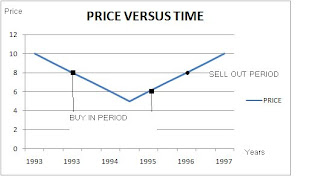

Start buying in when RM 8 there is decrease 20% of it maximum NAV, use the same amount of money such as RM 1000, to buy in stock until RM 6 the increasing value 20% of the minimum NAV. Sell out when reach RM8. COMMENT: Winner is calm and smart, loser is greedy and STUPID!

Using the same amount money to buy in stock, you will find the quantities that you bought are increasing. At last, you will find average stock price is RM 6.24. Sell out when RM8.

Total cost price RM 5000.00

Profit earning RM 1409.52

Investment period 3 1/2 years.

Effective interest rate is about 7% yearly, alternative method to overcome Malaysia inflation rate 5%-6%.

Advice: Don't put all your money into share only!! Share is unpredictable! It will give you negative return and burn out your capital! BE SMART OK!!