After attending the Financial Planning Workshop Part Two, my personal summary is:

Why do people invest?

To provide capital and income at some future time, (money at work)

To beat inflation.

Investment divided into 5 categories, that is

- investing, purchase financial product with expectation of favorable return in long term basic more on property, unit trust, bond...

- trading, buy and sell in short term basic, may buy share....

- speculating following the market trend, like purchasing gold, oil, currency..( dangerous that if you buy after the trend of market, you sure will be a big loser...)

- gambling, toto, genting highland

- banking earn interest via fix deposit

Risk diversify

In this section, is only for those their investment goal is to beat inflation.

Knowledge from China, RED CLIFF 1 AND 2, 三分天下! Meaning that diversify your investment into 3 categories. That is 33% into investing, 33% into trading and speculating, 34% into fix deposit. percentage adjusting must do it once a year in order you do not bias into either categories.

Cost averaging method

In this section, is only for those their investment goal is to beat inflation.

Knowledge from China, RED CLIFF 1 AND 2, 三分天下! Meaning that diversify your investment into 3 categories. That is 33% into investing, 33% into trading and speculating, 34% into fix deposit. percentage adjusting must do it once a year in order you do not bias into either categories.

Cost averaging method

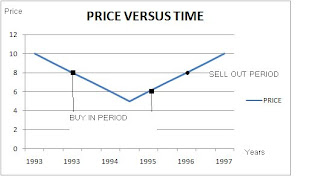

FOR EXAMPLE

Start buying in when RM 8 there is decrease 20% of it maximum NAV, use the same amount of money such as RM 1000, to buy in stock until RM 6 the increasing value 20% of the minimum NAV. Sell out when reach RM8. COMMENT: Winner is calm and smart, loser is greedy and STUPID!

Using the same amount money to buy in stock, you will find the quantities that you bought are increasing. At last, you will find average stock price is RM 6.24. Sell out when RM8.

Investment period 3 1/2 years.

Effective interest rate is about 7% yearly, alternative method to overcome Malaysia inflation rate 5%-6%.

Advice: Don't put all your money into share only!! Share is unpredictable! It will give you negative return and burn out your capital! BE SMART OK!!

Start buying in when RM 8 there is decrease 20% of it maximum NAV, use the same amount of money such as RM 1000, to buy in stock until RM 6 the increasing value 20% of the minimum NAV. Sell out when reach RM8. COMMENT: Winner is calm and smart, loser is greedy and STUPID!

Using the same amount money to buy in stock, you will find the quantities that you bought are increasing. At last, you will find average stock price is RM 6.24. Sell out when RM8.

Total sell out RM 6409.52

Total cost price RM 5000.00

Profit earning RM 1409.52

** Profit may be charged on duty fee, management fee too...Total cost price RM 5000.00

Profit earning RM 1409.52

Investment period 3 1/2 years.

Effective interest rate is about 7% yearly, alternative method to overcome Malaysia inflation rate 5%-6%.

Advice: Don't put all your money into share only!! Share is unpredictable! It will give you negative return and burn out your capital! BE SMART OK!!

No comments:

Post a Comment